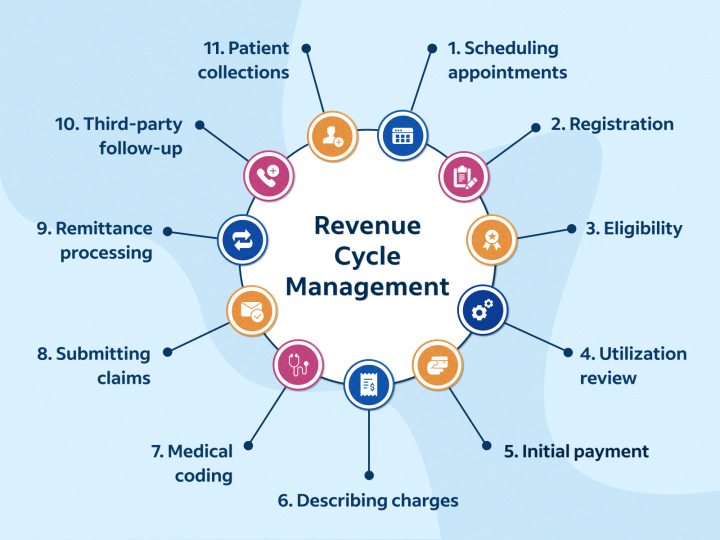

In today’s increasingly complex healthcare landscape, revenue cycle management (RCM) has emerged as a linchpin in ensuring the financial well-being of healthcare organizations. It encompasses the intricate process of managing claims, payments, and revenue generation, commencing when a patient seeks care and culminating with the final reimbursement.

This comprehensive guide aims to delve into the key components and nuances of revenue cycle management, providing insights into the critical steps that healthcare providers must adeptly navigate to secure financial sustainability.

Patient Pre-registration { Revenue Cycle Management }:

The revenue cycle management commences with the often-overlooked but pivotal stage of patient pre-registration. Here, healthcare facilities diligently collect crucial patient information, encompassing insurance details, contact information, and demographic data.

The accuracy of data collection at this early juncture proves pivotal in minimizing billing errors further downstream. Furthermore, this initial phase involves verifying insurance eligibility and benefits, an essential step in determining coverage and potential patient responsibilities.

Patient Registration and Scheduling:

The registration and scheduling phase plays a pivotal role in RCM moving forward in the patient’s journey. During this stage, healthcare staff confirm appointments and diligently update patient records with any changes or additional information.

An efficiently managed scheduling system ensures patients are seen promptly, thus significantly mitigating the risk of missed appointments or cancellations that can adversely affect revenue.

Eligibility Verification:

Verifying a patient’s insurance eligibility and benefits is important in the revenue cycle management. Accurate verification is paramount for averting claim denials and minimizing the likelihood of unpaid services. This multifaceted step involves confirming the patient’s coverage, co-pays, deductibles, and pre-authorization prerequisites.

Charge Capture:

Charge capture represents a critical juncture in RCM where meticulous documentation and coding of patient services come into play. Healthcare providers are responsible for ensuring that all services are correctly coded to reflect the care delivered accurately. Any lapses in this step can lead to claim denials or underpayments, compromising revenue.

Claims Submission:

Upon meticulous documentation and coding of services, healthcare organizations embark on the crucial step of claims submission. This entails compiling the necessary documentation and ensuring that claims align with the specific requirements of each payer. Precise and timely claims submission is paramount in maintaining a healthy cash flow.

Claims Adjudication:

Claims adjudication is where insurance companies assume the mantle of reviewing and processing claims. This intricate process includes verifying the coding accuracy, determining coverage, and calculating payment amounts. The timeliness and precision of claims adjudication are imperative to sustain a robust financial footing.

Denial Management:

Despite meticulous attention to detail, claim denials can inevitably occur. Effective denial management is indispensable, involving the identification of reasons for denials, the rectification of errors or issues, and the resubmission of claims promptly. Timely addressing of denials is imperative to prevent revenue leakage.

Patient Billing and Collections:

Post claims adjudication, the responsibility shifts to billing patients for any remaining balances. To mitigate patient confusion and encourage timely payments, it is essential to have transparent and easy-to-understand billing practices. Healthcare organizations often extend payment plans or financial assistance programs to support patients facing financial constraints.

Payment Posting:

The journey of payments is a critical component within the intricate web of revenue cycle management. As funds are received from insurance companies or patients, the responsibility shifts to post these payments to the respective patient accounts accurately.

This seemingly routine but profoundly significant step ensures that the organization’s financial records remain current and meticulously up-to-date. The art of payment posting transcends mere data entry; it’s a meticulous process that underpins the financial health of healthcare organizations.

At its core, payment posting involves reconciling received payments with corresponding claims and outstanding balances. This reconciliation ensures that every dollar received is accounted for, leaving no room for discrepancies that could disrupt the organization’s financial stability.

Healthcare facilities gain insight into their revenue streams by diligently recording payments, enabling them to make informed decisions about their financial health and strategy.

Accounts Receivable Management:

Accounts receivable management is the cornerstone of maintaining a stable revenue stream for healthcare organizations. This multifaceted process extends beyond a simple ledger of outstanding payments; it is an ongoing, dynamic endeavor demanding vigilance and strategic finesse.

One of the primary objectives of accounts receivable management is to monitor outstanding payments with unwavering attention. Healthcare facilities must meticulously track every outstanding balance, ensuring no payment falls through the cracks.

This proactive approach allows organizations to identify bottlenecks, whether they stem from payer issues, coding errors, or patient disputes, and address them promptly.

Identifying and resolving delinquent accounts is another integral facet of accounts receivable management. Delinquent accounts can significantly impact an organization’s cash flow and financial stability.

A structured approach to identifying such accounts, coupled with effective communication and resolution strategies, can help minimize the negative impact of delinquencies.

Pursuing payers and patients to secure outstanding funds represents the assertive side of accounts receivable management. This task involves contacting insurance companies and patients to ensure payments are made promptly.

Timely follow-ups and clear communication can significantly expedite the resolution of outstanding balances, thereby bolstering the organization’s financial resilience.

Reporting and Analytics:

Optimizing revenue cycle management is contingent upon harnessing the power of data-driven insights. Reporting and analytics tools become invaluable in identifying trends, assessing performance, and making informed decisions that enhance processes and augment financial outcomes.

Compliance and Auditing:

Remaining compliant with the dynamic landscape of healthcare regulations and conducting regular audits constitutes a cornerstone of revenue cycle management. Ensuring billing practices align with legal requirements is indispensable in preempting costly penalties and legal complications.

Conclusion:

Revenue cycle management is an intricate and multifaceted process that demands meticulous attention to detail, efficient workflows, and an unwavering commitment to continuous improvement. By mastering each key component elucidated in this comprehensive guide, healthcare organizations stand poised to fortify their financial stability, elevate patient satisfaction, and deliver superior care.

In an ever-evolving healthcare landscape, the effective orchestration of revenue cycle management remains a linchpin of enduring success.